cumulative preferred stockholders have the right to receive

In this case the. D Preferred stockholders do not have the right to subscribe to a rights offering.

Cumulative Preferred Stock Definition Business Example Advantages

Choo Cumulative feature Enables stockholders.

. Cumulative preferred stock is a. A have the right to receive dividends only in the years the board of directors declares dividends. Cumulative preferred stockholders receive a dividend that is paid to them on the same date each year.

Shareholders cant demand that the corporation pay a dividend. By contrast if a company issues. Preferred stock also has first right to dividends.

Each of the choices below is a right or preference associated with preferred stock except A. Preferred stock shareholders will have claim to assets over common stock shareholders in the case of company liquidation. If preferred stock is designated as cumulative the suspended dividends accumulate and you.

These dividends are not carried over to subsequent years. The guaranteed dividend for these. They have the right to receive a dividend whether one is declared or not.

200 per share to the shareholders. Cumulative preferred stock dividends that have not been paid in prior years are said to be____. Preferred stock valuation is similar in nature to bond valuation.

If the preferred stock is noncumulative. This means that the. Preferred shareholders usually have the right to receive a dividend before common shareholders.

Once all cumulative shareholders receive. With cumulative preferred stock unpaid dividends pass to future years and have to be paid out before dividends for common stockholders. However stock proceeds from issuing.

If the preferred stock is cumulative. Preference shares more commonly referred to as preferred stock are shares of a companys stock with dividends that are paid out to shareholders before common stock. Cumulative Preferred Stocks are considered one of.

You may retain the right to suspend payment of dividends. Cumulative preferred stock is a type of preferred stock with a provision that stipulates that if any dividend payments have been missed in the past the dividends owed must be paid out to. Cumulative preferred stock shareholders are treated differently because they have the right to receive a dividend whether one is declared or not.

To pay dividends to common shareholders in 2021 you would need to pay preferred shareholders a total of 15 per share for the 2019 2020 and 2021 dividends. Cumulative preferred stocks are entitled to receive all the missed unpaid dividends. Preferred stockholders have a right to receive current and unpaid prior-year dividends before common stockholders receive any dividends.

Traditionally cumulative preferred stocks have a stated dividend yield that is based on the par value of the share. A priority claim to receive dividends in arrears before common stockholders receive dividends. By contrast if a company issues noncumulative preferred stock its preferred shareholders have no future right to receive dividends that the company chooses not to pay.

It is a reliable source and is valued among investors. This dividend is payable quarterly semi-annually or annually. Participating preferred stock gives the holder the right to a specific dividend.

Consider the case of XYZ Ltd which has issued cumulative preference shares with a face value of Rs. With cumulative preferred stock the company must keep track of the dividends it chooses not to pay to its preferred shareholders. Each quarter of the financial.

Annual dividend on preferred stock. Preferred stockholders have a right to receive current and unpaid prior-year dividends before common stockholders receive any dividends. Participating preferred stockholders are entitled to a liquidation preference which allows them to receive a.

If a stock is noncumulative these. Cumulative preferred stockholders have the right to receive _____ before common. Cumulative preferred stock shareholders are treated differently than other preferred stock investors.

160000 06 9600.

What Is Preferred Stock Robinhood

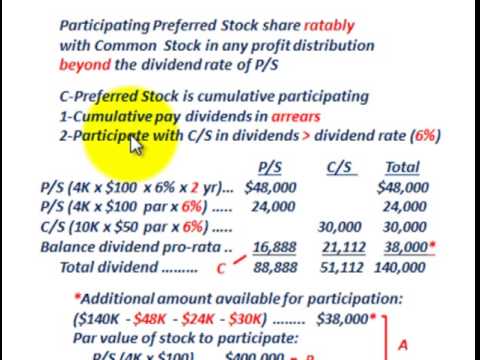

Preferred Stock Cumulative Vs Noncumulative Participating Vs Nonparticipating Dividends Youtube

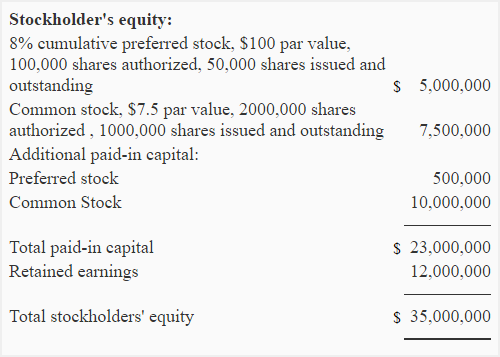

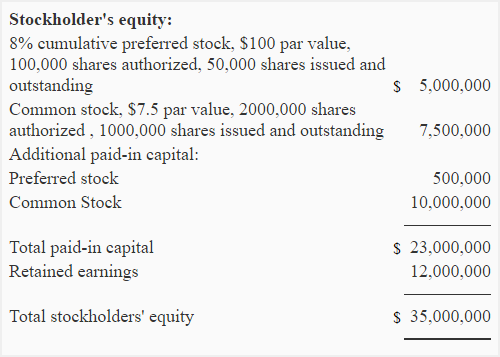

Common And Preferred Stock Explanation And Balance Sheet Presentation Accounting For Management

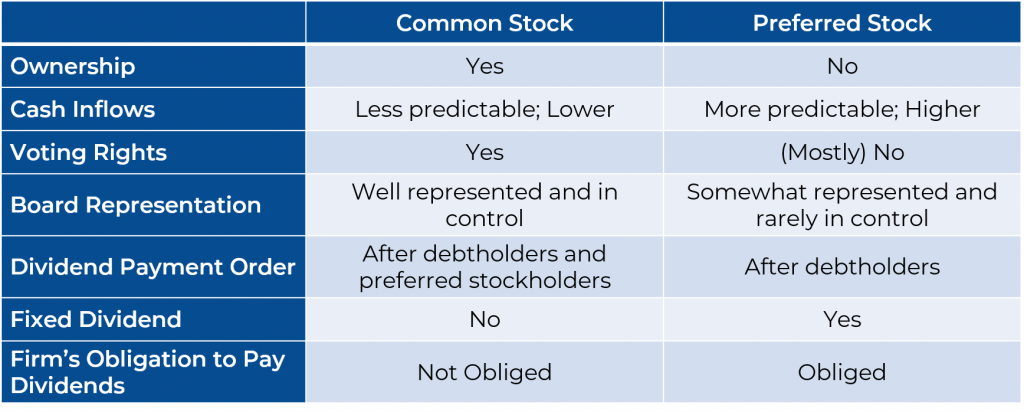

Common Stock Vs Preferred Stock 365 Financial Analyst

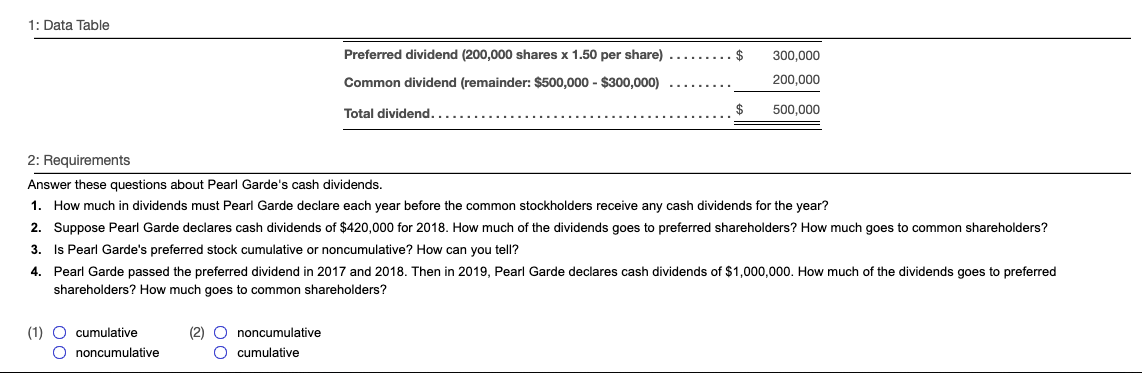

Solved 1 Pearl Garde Corporation Has 200 000 Shares Of Chegg Com

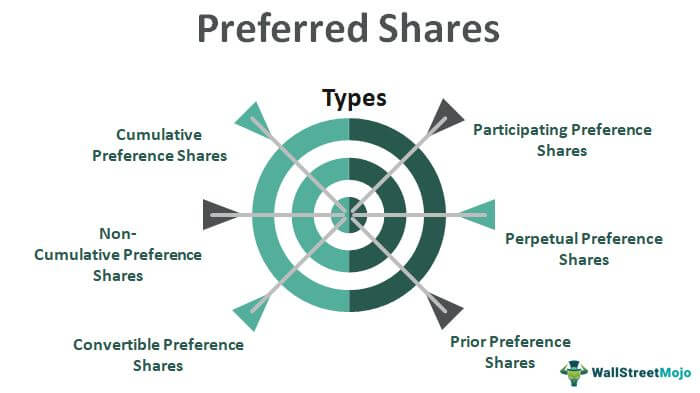

Preferred Shares Meaning Examples Top 6 Types

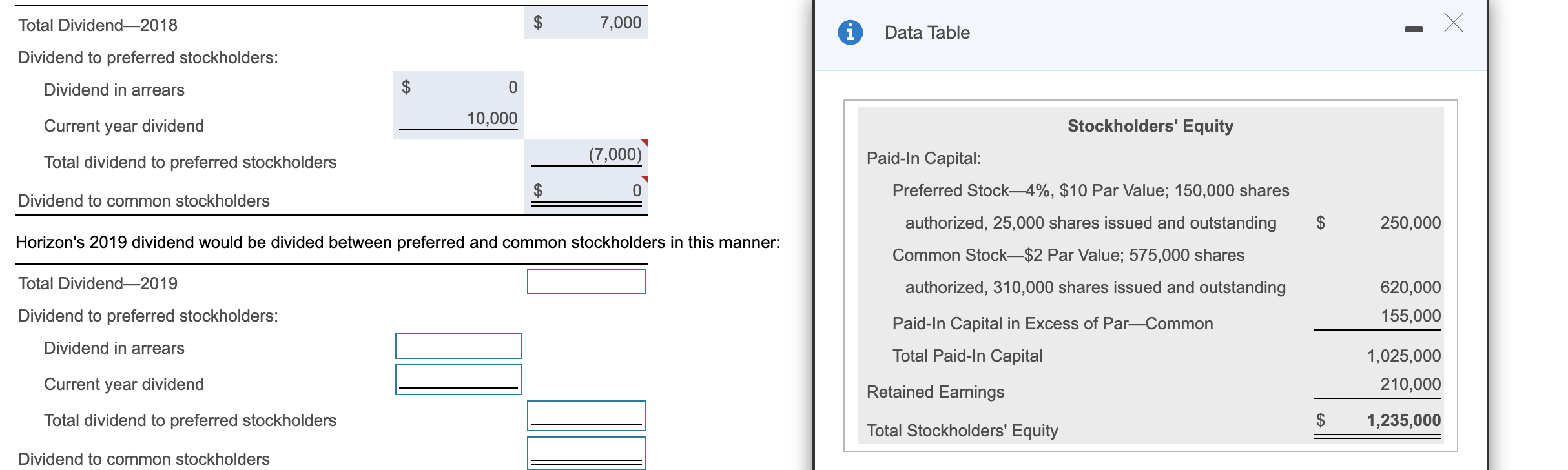

Solved Requirement 1 Assuming The Preferred Stock Is Chegg Com

Common Stock Vs Preferred Stock 365 Financial Analyst

Accounting Ch 13 Flashcards Quizlet

Cumulative Preferred Stock Definition

Common Stock Vs Preferred Stock A Guide Equitynet

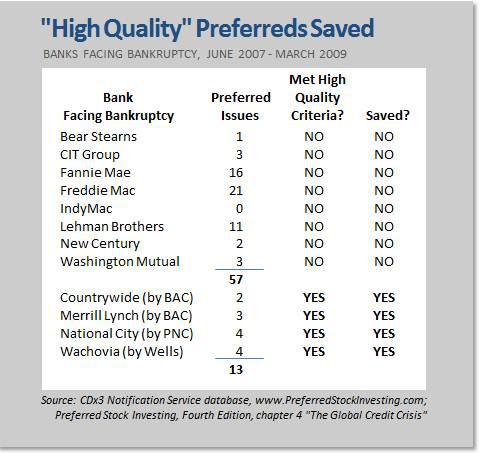

Cumulative Preferred Stock Dividend Characteristic Saves Citizens Republic Shareholders Nasdaq Crbc Seeking Alpha

Common Shares Vs Preferred Shares Comparison Of Equity Types

/book-with-page-about-preferred-stock--trading-concept--814447584-db8f837c330d4d8e9974c345d342867d.jpg)

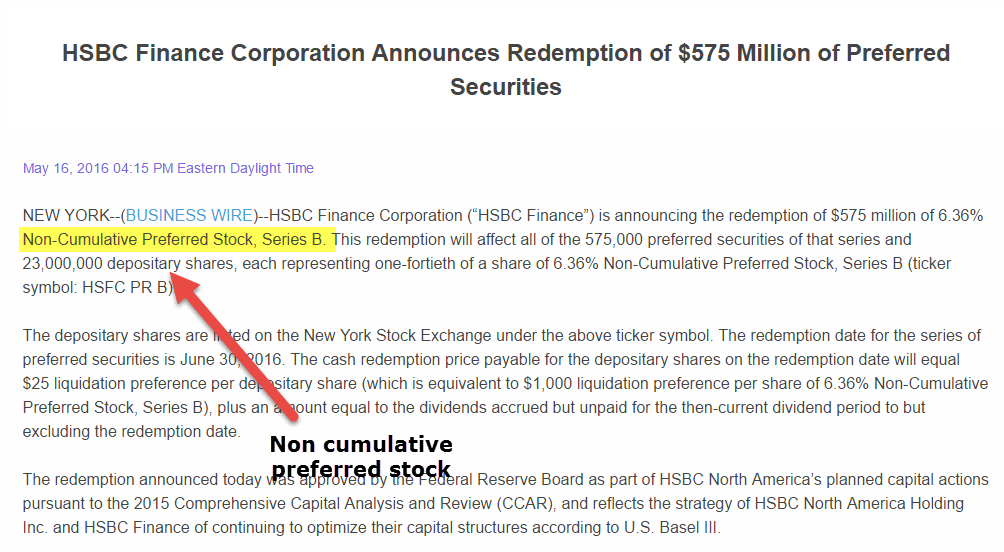

Noncumulative Definition And Examples

Preferred Shares Meaning Examples Top 6 Types

Preferred Shares Meaning Examples Top 6 Types

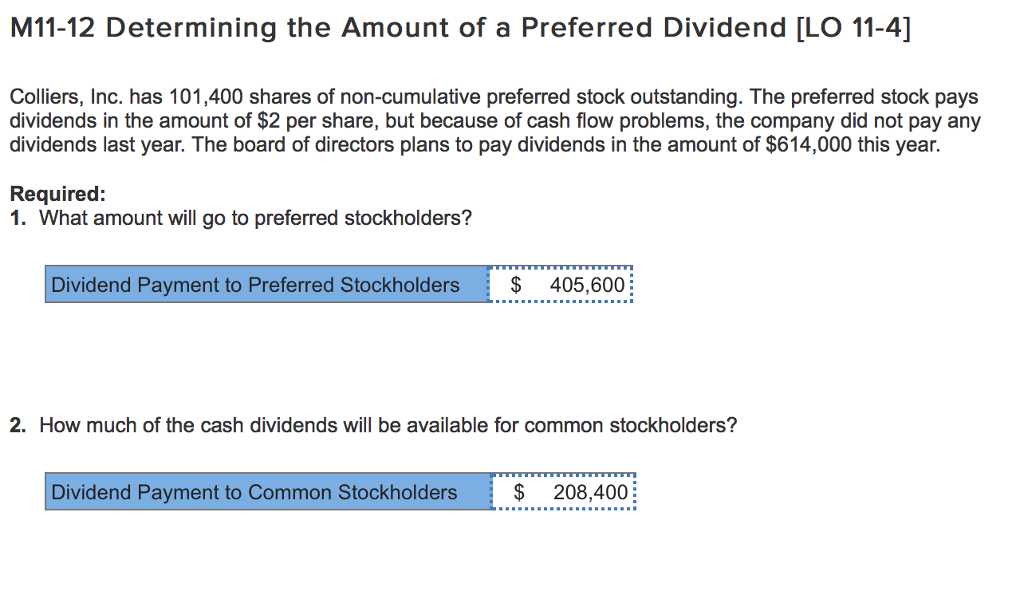

Solved M11 12 Determining The Amount Of A Preferred Dividend Chegg Com

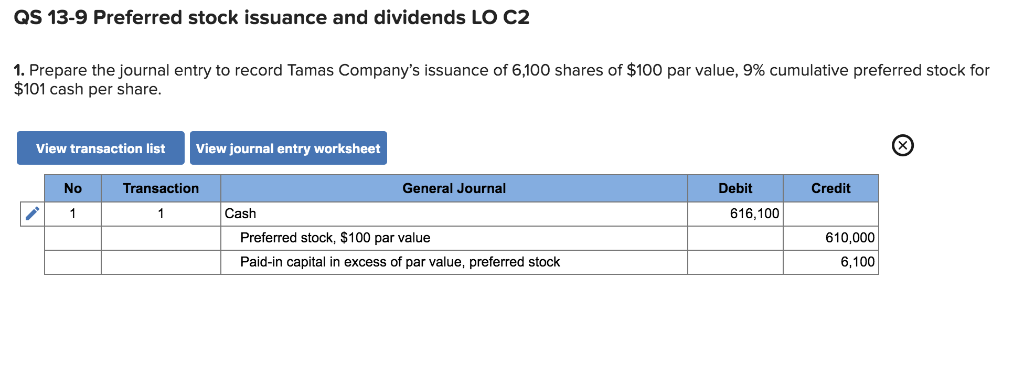

Solved Qs 13 9 Preferred Stock Issuance And Dividends Lo C2 Chegg Com